Reverse Mortgage For Purchase (H4P)

Your dream home

in retirement

Your dream home in retirement

A Home Equity Conversion Mortgage—also known as a reverse mortgage—for Purchase (H4P) is a Federal Housing Administration (FHA)-insured home loan that is designed to help homebuyers age 62+ to buy a new home that better meets their current lifestyle.

How the Product Works

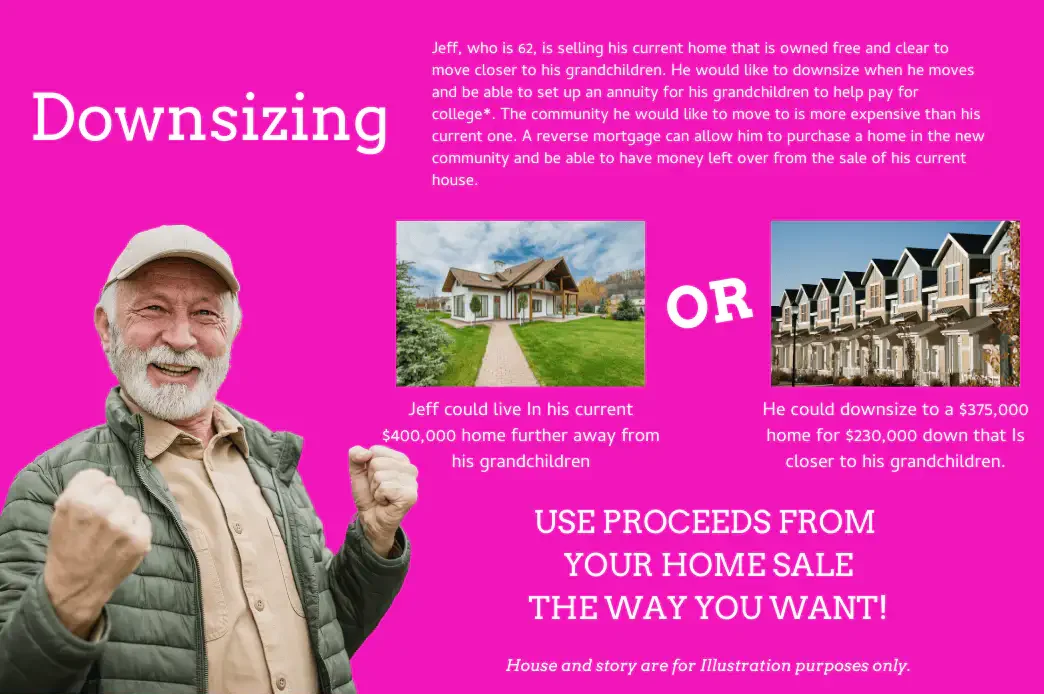

The product allows you to combine a down payment from your own funds (e.g., proceeds from the sale of your current home) with the proceeds from the H4P loan to complete the purchase. The amount that you would be required to put down is roughly 40 percent to 60 percent of sales price of the home you are buying. The required down payment is determined by the age of the youngest borrower, the current interest rates, and the purchase price of the new home.

You have the option to repay as much or as little of the loan balance each month as you would like, or you can make no monthly mortgages payments at all. The FHA guarantees that as long as you meet your loan obligations (which include maintaining the home and paying for property taxes and homeowners insurance), no repayment of the loan is required until the last borrower moves out or passes away. When the loan becomes due, you or your estate has up to 12 months to repay the loan balance, which is typically achieved by selling the home.

H4P INformation

- Increase your purchasing power to buy the home you really want.

- Free up cash flow—you will not be obligated to make monthly mortgage payments. You still must maintain the home and pay taxes and homeowners insurance.

- Extend the life of your productive retirement assets.

- Qualify for a mortgage in retirement. There are minimal income and credit requirements.

The borrower(s) must:

- Be 62 years or older*

- Live in the home as his or her primary residence and either own the home outright or have significant equity in the home

- Meet minimum credit and property requirements

- Must receive reverse mortgage counseling from a HUD-approved counseling agency

- Must not be delinquent on any federal debts

*Some programs allow you to get a Reverse Mortgage at age of 55

- Single family residence.

- 2- to 4-unit properties.

- Manufactured homes.

- Modular homes.

- Planned unit developments.

- Townhomes.

- FHA-approved condominium.

Increase Your Purchasing Power

This information is provided as a guideline and does not reflect the final outcome for any particular homebuyer or property. The actual reverse mortgage available funds are based on current interest rates, current charges associated with loan, borrower date of birth (or non-borrowing spouse, if applicable), the property sales price and standard closing cost. Interest rates and loan fees are subject to change without notice. Following the closing of the home purchase, no further principal or interest payments will be required as long as one borrower occupies the home as their primary residence and adheres to all HUD guidelines of loan. Borrower must remain current on property taxes, homeowner’s insurance (and homeowner association dues, if applicable), and home must be maintained.

Need some numbers? We can help!

You probably

have questions...

Here are just a few questions we get, you can view more FAQ’s by clicking below.

Is a reverse purchase the same as a reverse mortgage?

With a Home Equity Conversion Mortgage, you are borrowing against equity in your current home. With a reverse mortgage for purchase, you are purchasing a new primary residence and providing the required equity by way of a down payment at closing from your own funds.

Do I own my home with a HECM for purchase?

Yes! You still retain ownership of the home over the life of the loan. The HECM for Purchase loan is simply secured with a lien, just like a traditional mortgage or a home equity line of credit.

Is there a Mortgage Insurance Premium (MIP)?

Yes, these premiums are usually financed into the loan and not paid out of pocket – their purpose is to fund the non-recourse feature, which protects you or your heirs from being stuck with a bill if your loan balance is higher than what your home sells for when the loan matures and is due and payable.

I want to buy a new construction home — can I start the application before the home is completed?

Yes. You can complete the HECM for Purchase application and begin the process of securing the loan, but the appraisal, and consequently the loan closing, cannot happen until the Certificate of Occupancy has been issued

Over the phone we can ask you a few questions and get some basic financial information and give you the information necessary in order to see how a reverse mortgage could improve your situation.

You can fill out the form to the right and we can send you some reading material you can review.